Many people believe coin collecting isn’t investing at all, it’s a hobby. Therefore, being a hobby–it should not really bother you to overpay for things, or whatever–if it’s for your enjoyment great, enjoy. But, if you would like to buy coins that could have some strong upside, later on. Then we should look at coins for different time horizons. We’ve prepared a short, medium and long term report for each time period that you might be interested in and what coins could be worth looking at. Now, this isn’t financial advice, it’s just for informational and educational purposes only. In short, it’s our opinion. Don’t make any investment decisions without contacting a professional.

What does “high convexity” mean?

A high convexity play in the context of buying a coin refers to an investment in a coin that has the potential for disproportionately large price increases relative to its current price, often due to unique or underappreciated characteristics. In other words, it describes a situation where the upside potential significantly outweighs the downside risk, especially if certain catalysts (like a CAC sticker, grade reconsideration, market recognition, or emerging demand) occur.

In numismatics, high convexity plays often involve coins that are:

- Undervalued or mispriced relative to their true rarity or condition

- Undergraded or possessing qualities that could warrant a higher grade upon resubmission

- Likely to gain premium recognition if submitted to CAC or similar grading verification

- In thinly traded or low-population categories, where new demand can drive prices up sharply

In short, it’s a coin purchase where small improvements in market perception, grade, or certification could lead to outsized returns, similar to how convexity is understood in finance—nonlinear gains for incremental changes in underlying factors.

Selection Criteria for Short-Term High Convexity Candidates

For the short-term investment horizon (1-2 years), we’ve applied the following criteria to identify coins with the highest convexity potential:

- Current Momentum: Coins showing recent price appreciation but not yet at peak premium levels

- Market Recognition Factors: Emerging trends in certification, aesthetics, or collector preferences

- Supply Constraints: Limited available inventory in the target grade

- Demand Catalysts: Identifiable factors likely to increase demand in the next 12-24 months

- Downside Protection: Strong collector base or intrinsic value providing price support

- Liquidity Profile: Sufficient market depth to allow exit within the target timeframe

- Price Point: Under $5,000 per the client’s specified ceiling

Top 10 High Convexity Coins for Short-Term Investment (1-2 Years)

1. 1884-CC Morgan Dollar with Premium Rainbow Toning (MS63-MS64 CAC)

- Current Price Range: $$$

- Convexity Factors:

- Carson City premium provides strong price floor

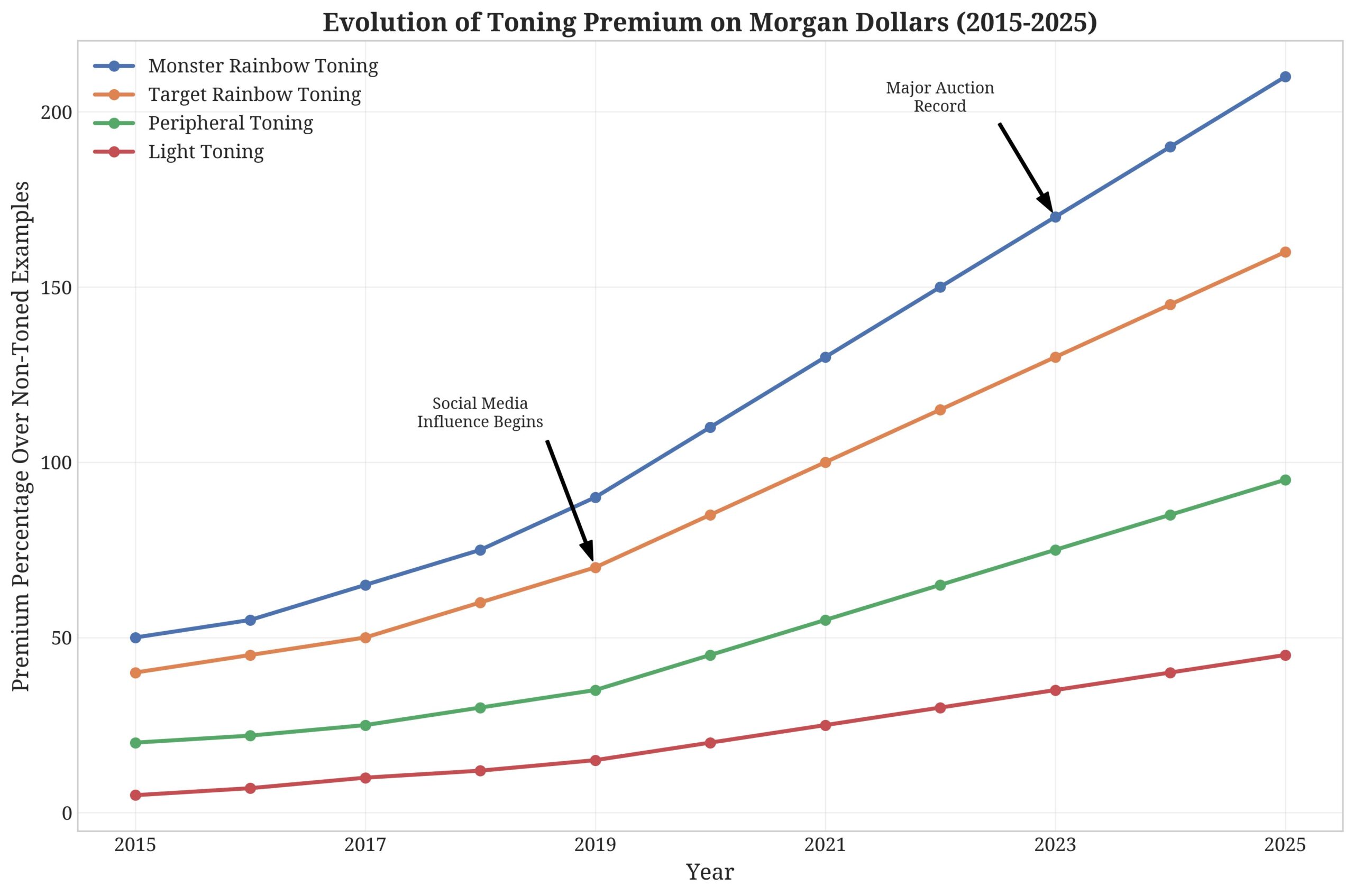

- Toning premium expansion accelerating (25-150% premium)

- CAC approval adds 20-40% premium

- GSA holder adds 10-20% premium when applicable

- Market Analysis:

- Toned Morgan dollars showing strongest recent momentum

- CAC population in MS63-MS64 with attractive toning extremely limited

- Multiple demand drivers: CC collectors, toning enthusiasts, GSA collectors

- Short-Term Catalyst:

- Growing premium for aesthetic quality across all Morgan dollars

- Increasing recognition of toning premium by third-party graders

- Strong performance in recent auctions for premium examples

2. 1942 Mercury Dime (MS67 FB CAC)

- Current Price Range: $$

- Convexity Factors:

- Population rarity in MS67 FB (fewer than 200 examples)

- CAC approval adds 30-50% premium

- Type coin demand provides strong price floor

- WWII-era historical significance

- Market Analysis:

- Registry set competition driving demand for population-scarce grades

- MS67 FB examples showing strongest recent price momentum

- CAC approval rate under 30% for submitted coins

- Short-Term Catalyst:

- Increasing collector focus on registry set completion

- Growing premium for superb gem examples across all series

- Relatively affordable entry point compared to key dates

3. 1953-S Franklin Half Dollar (MS66 FBL CAC)

- Current Price Range: $$$$

- Convexity Factors:

- Population rarity in MS66 FBL (fewer than 150 examples)

- CAC approval adds 30-50% premium

- Full Bell Lines premium expanding rapidly

- San Francisco mint premium

- Market Analysis:

- Registry set competition driving prices for condition rarities

- FBL premium has expanded from 100% to 200% in last 36 months

- MS66 examples showing strongest price momentum

- Short-Term Catalyst:

- Increasing collector focus on registry set completion

- Growing recognition of strike rarity for S-mint issues

- Relatively affordable compared to key dates in the series

4. $5 Indian Head Half Eagle (1908-1929, MS62 CAC)

- Current Price Range: $$$

- Convexity Factors:

- Gold content provides intrinsic value floor

- Incuse design with historical significance

- CAC approval adds 20-30% premium

- Type coin demand across multiple collector categories

- Market Analysis:

- Gold price momentum providing strong support

- MS62 grade offers optimal balance of quality and value

- CAC population relatively limited in this grade

- Short-Term Catalyst:

- Increasing gold prices driving renewed interest

- Growing premium for CAC-approved examples

- Relatively affordable entry point for pre-1933 gold

5. 1883-O Morgan Dollar with Monster Rainbow Toning (MS64 CAC)

- Current Price Range: $$

- Convexity Factors:

- Exceptional toning commanding 50-150% premium

- CAC approval adds 30-40% premium

- New Orleans mint premium

- Type coin demand provides strong price floor

- Market Analysis:

- Toned Morgan dollars showing strongest recent momentum

- MS64 grade offers optimal balance of quality and value

- O-mint coins with premium toning especially scarce

- Short-Term Catalyst:

- Growing premium for aesthetic quality

- Increasing recognition of toning premium by auction houses

- Strong performance in recent auctions for premium examples

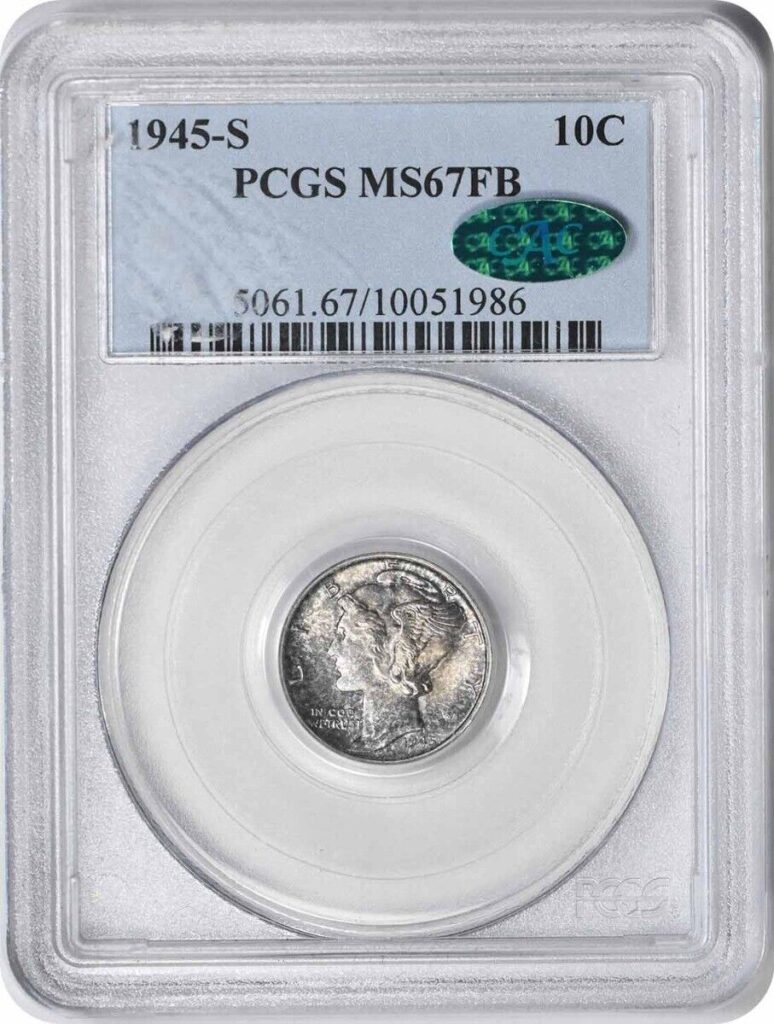

6. 1945-S Mercury Dime (MS67+ FB CAC)

- Current Price Range: $

- Convexity Factors:

- Population rarity in MS67+ FB (fewer than 50 examples)

- CAC approval adds 30-50% premium

- Plus grade adds 20-30% premium

- Last year of issue premium

- Market Analysis:

- Plus grades showing strongest recent price momentum

- Registry set competition driving demand for finest known examples

- Last year of issue coins consistently outperforming

- Short-Term Catalyst:

- Increasing collector focus on plus grades

- Growing premium for superb gem examples

- Final year of iconic design series

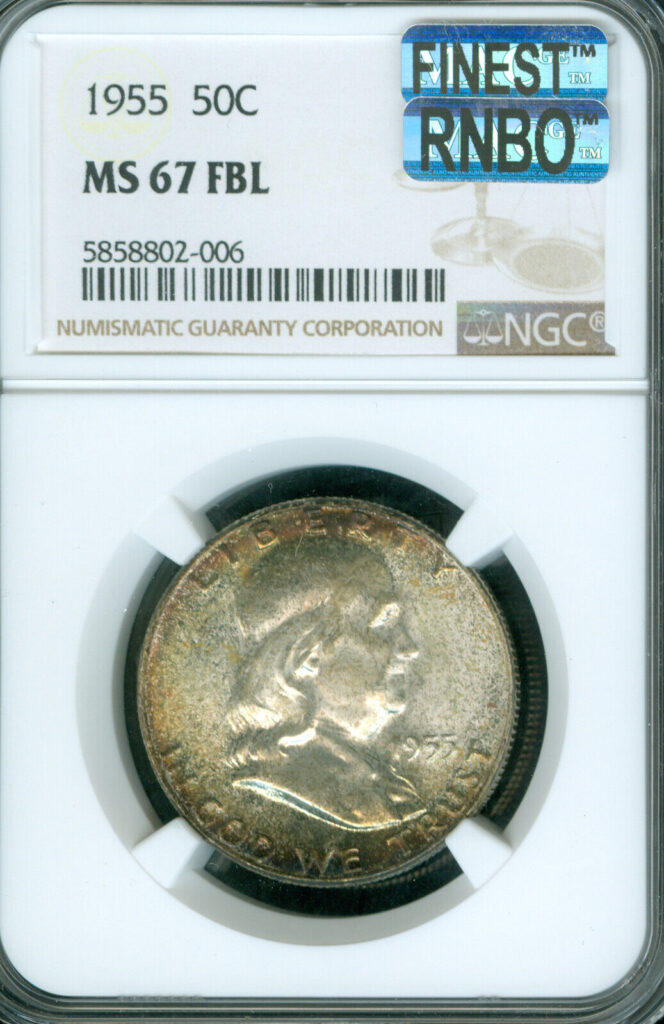

7. 1955 Franklin Half Dollar (MS66+ FBL CAC)

- Current Price Range: $$

- Convexity Factors:

- Population rarity in MS66+ FBL (fewer than 100 examples)

- CAC approval adds 30-50% premium

- Plus grade adds 20-30% premium

- Full Bell Lines premium expanding rapidly

- Market Analysis:

- Registry set competition driving prices for condition rarities

- Plus grades showing strongest recent price momentum

- MS66+ examples particularly scarce with FBL designation

- Short-Term Catalyst:

- Increasing collector focus on plus grades

- Growing recognition of strike rarity

- Strong recent auction results for premium examples

8. 1936 Bay Bridge Commemorative Half Dollar (MS66+ CAC)

- Current Price Range: $$

- Convexity Factors:

- Population rarity in MS66+ (fewer than 150 examples)

- CAC approval adds 30-40% premium

- Plus grade adds 20-30% premium

- One-year type with architectural theme

- Market Analysis:

- Classic commemoratives showing recovery after prolonged stagnation

- MS66+ examples showing strongest recent price momentum

- Architectural theme coins gaining collector interest

- Short-Term Catalyst:

- Increasing collector interest in classic commemoratives

- Growing premium for superb gem examples

- Relatively affordable compared to early commemoratives

9. 1881-S Morgan Dollar with Deep Mirror Prooflike Fields (MS64 DMPL CAC)

- Current Price Range: $$$$

- Convexity Factors:

- DMPL premium expanding rapidly (50-100% premium)

- CAC approval adds 30-40% premium

- Type coin demand provides strong price floor

- San Francisco mint quality

- Market Analysis:

- DMPL examples showing strong recent momentum

- MS64 grade offers optimal balance of quality and value

- CAC population relatively limited for DMPL examples

- Short-Term Catalyst:

- Growing premium for coins with special visual characteristics

- Increasing recognition of DMPL premium by collectors

- Strong performance in recent auctions for premium examples

10. 1908 $2.50 Indian Head Quarter Eagle (MS62 CAC)

- Current Price Range: $$

- Convexity Factors:

- Gold content provides intrinsic value floor

- First year of issue premium

- CAC approval adds 20-30% premium

- Incuse design with historical significance

- Market Analysis:

- First year of issue coins consistently outperforming

- Gold price momentum providing strong support

- MS62 grade offers optimal balance of quality and value

- Short-Term Catalyst:

- Increasing gold prices driving renewed interest

- Growing premium for first-year issues

- Relatively affordable entry point for pre-1933 gold

Short-Term Investment Strategy Recommendations

Acquisition Strategy

- Focus on Certification Quality:

- Prioritize CAC-approved examples

- Consider plus grades when available

- Ensure holder type matches the coin (e.g., GSA holders for CC Morgans)

- Visual Appeal Factors:

- For Morgan Dollars, prioritize attractive toning or DMPL characteristics

- For Mercury Dimes and Franklin Halves, ensure Full Bands/Lines are bold

- For gold coins, look for original surfaces and minimal bag marks

- Acquisition Timing:

- Target seasonal buying opportunities (summer months typically softer)

- Monitor auction schedules for opportunities to acquire below retail

- Consider dealer inventory during major shows for best selection

- Diversification Approach:

- Allocate across at least 5 different categories from the list

- Balance silver and gold content

- Mix certification-driven and aesthetic-driven opportunities

Holding Recommendations

- Monitoring Triggers:

- Track auction results for comparable examples quarterly

- Monitor population reports for changes in certification trends

- Watch for shifts in collector preferences or grading standards

- Exit Strategy Planning:

- Establish target price points based on historical premium levels

- Identify optimal selling venues for each category

- Prepare for opportunistic sales if premiums expand rapidly

- Risk Management:

- Maintain awareness of spot metal prices for intrinsic value floor

- Monitor overall market sentiment through key auction results

- Be prepared to extend holding period if short-term catalysts don’t materialize

Portfolio Construction Options

Aggressive Growth Portfolio ($5,000 budget)

- 1884-CC Morgan Dollar with Premium Rainbow Toning (MS64 CAC): $750

- 1942 Mercury Dime (MS67 FB CAC): $350

- 1953-S Franklin Half Dollar (MS66 FBL CAC): $700

- $5 Indian Head Half Eagle (MS62 CAC): $1,200

- 1883-O Morgan Dollar with Monster Rainbow Toning (MS64 CAC): $950

- 1945-S Mercury Dime (MS67+ FB CAC): $500

- 1955 Franklin Half Dollar (MS66+ FBL CAC): $550

- Total Investment: $5,000

- Potential 2-Year Return: 70-90%

Balanced Growth Portfolio ($5,000 budget)

- 1884-CC Morgan Dollar with Premium Rainbow Toning (MS63 CAC): $500

- 1942 Mercury Dime (MS67 FB CAC): $350

- 1953-S Franklin Half Dollar (MS66 FBL CAC): $700

- $5 Indian Head Half Eagle (MS62 CAC): $1,200

- 1908 $2.50 Indian Head Quarter Eagle (MS62 CAC): $900

- 1936 Bay Bridge Commemorative Half Dollar (MS66+ CAC): $500

- 1881-S Morgan Dollar with Deep Mirror Prooflike Fields (MS64 DMPL CAC): $600

- Total Investment: $4,750

- Potential 2-Year Return: 50-70%

Conservative Growth Portfolio ($5,000 budget)

- 1884-CC Morgan Dollar with Premium Rainbow Toning (MS63 CAC): $500

- 1942 Mercury Dime (MS67 FB): $250

- 1953-S Franklin Half Dollar (MS66 FBL): $600

- $5 Indian Head Half Eagle (MS62): $1,000

- 1908 $2.50 Indian Head Quarter Eagle (MS62): $700

- 1936 Bay Bridge Commemorative Half Dollar (MS66): $400

- 1881-S Morgan Dollar with Deep Mirror Prooflike Fields (MS64 DMPL): $400

- 1883-O Morgan Dollar (MS64): $500

- Total Investment: $4,350

- Potential 2-Year Return: 40-60%

Market Timing Considerations

The current market environment (April 2025) presents several favorable factors for short-term high convexity investments:

- Precious Metal Support: Gold and silver prices providing strong support for numismatic values

- Certification Premium Expansion: CAC, plus grades, and special designations commanding increasing premiums

- Collector Base Expansion: Growing interest in U.S. coins from both traditional collectors and alternative asset investors

- Auction Strength: Recent auction results showing strong demand for premium quality examples

- Relative Value: Current premiums for many categories still below historical highs, suggesting room for expansion

The 1-2 year horizon allows sufficient time for these market factors to drive appreciation while minimizing exposure to longer-term market cycles. The selected coins offer an optimal balance of current momentum, identifiable catalysts, and downside protection for this timeframe.

Leave a Reply