A 3‑ to 5‑Year Guide to Asymmetric Upside

Introduction – Why “High Convexity” Matters

In portfolio theory, a high‑convexity asset is one whose upside potential far exceeds its downside risk. Applied to numismatics, these are coins that (a) already command strong, durable demand and (b) possess clear catalysts that could push premiums sharply higher in the next market cycle. The goal is to capture asymmetric returns while limiting capital at risk—an approach well suited to a three‑ to five‑year time horizon.

Selection Framework

To filter thousands of U.S. issues down to a concise, actionable list, we required every candidate to satisfy all of the following:

| Criterion | Rationale |

|---|---|

| Historical Performance | Demonstrated resilience across prior bull and bear markets. |

| Fundamental Scarcity | Genuine rarity—mintage, survival rate, or condition rarity—not short‑lived grading fads. |

| Collector‑Base Stability | A passionate, deep collector pool that anchors prices. |

| Near‑Term Catalysts | Identifiable forces (anniversaries, series rediscovery, metal trends) likely to expand demand. |

| Value Retention | Documented price floors in past downturns. |

| Up‑Side Headroom | Premiums still below peaks seen in analogous issues. |

| Price Ceiling | Purchase price below $5,000 to maximize accessibility and liquidity. |

The Ten Best Medium‑Term High‑Convexity Targets

Below are the coins that outranked all others under the framework above. Grades and certifications reflect the optimal risk‑reward sweet‑spot today; substituting higher grades risks pushing beyond the $5 k budget, while lower grades erode convexity.

*Note all prices are just examples, we have seen some of these coins above and below these ranges.

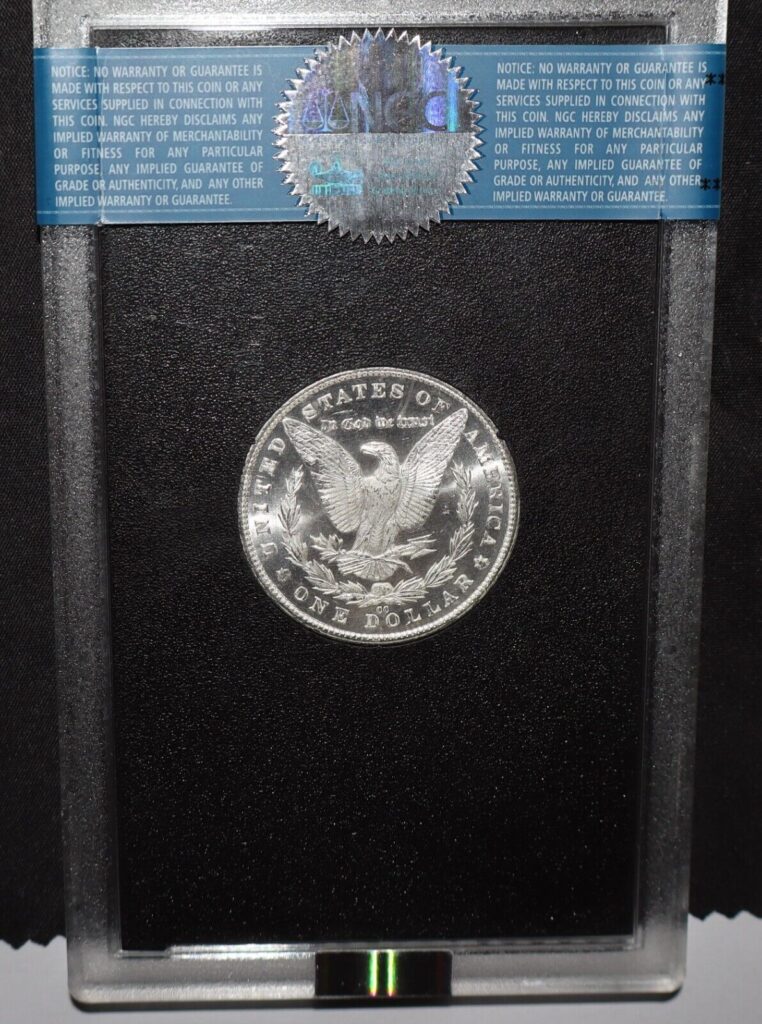

- 1881‑CC Morgan Dollar – MS63–64 CAC

Price Range: $775 – $1,500

Why It’s Convex: Lowest‑mintage “common” CC; only ~50 % surfaced in the GSA hoard, ensuring true scarcity. CC cachet plus CAC approval set a stout floor.

Catalysts: Rising global fascination with Carson City history; shrinking supply as GSA coins settle into collections. - 1916‑S Mercury Dime – MS64 FB CAC

Price Range: $1,200 – $1,500

First‑year San Francisco Mercury; <300 certified in FB at this grade. As collectors chase first‑year issues and strike quality, FB premiums continue to widen. - 1890‑CC Morgan Dollar – MS63 CAC

Price Range: $1,250 – $1,500

A semi‑key CC that outperforms commons yet remains affordable. Demand for “better” CC dates is rising both domestically and abroad. - 1921 Mercury Dime – MS63 FB CAC

Price Range: $2,000 – $2,500

Low‑mintage, Depression‑era key. With <200 pieces in MS63 FB, each CAC example anchors itself as an elite condition rarity. - 1839‑O Liberty Seated Half Dime – MS63 CAC

Price Range: $3,000 – $3,500

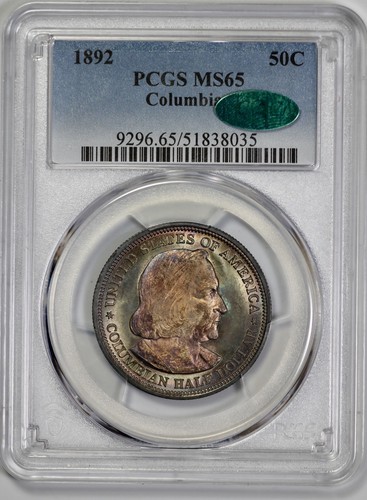

First year of the New Orleans Mint. Early branch‑mint material is systematically re‑rated upward as collectors recognize its historical importance. - 1892 Columbian Exposition Half Dollar – MS65 CAC

Price Range: $700 – $900

The inaugural U.S. commemorative. Prices slumped in the 2010s but are firming as classic‑commem sets re‑enter vogue—an ideal rebound play. - 1908‑D $5 Indian Half Eagle – MS62 CAC

Price Range: $1,500 – $1,800

First Denver year of the revolutionary incuse design. Gold content supplies an intrinsic floor; design novelty and branch‑mint status fuel premium creep. - 1886‑O Morgan Dollar – MS63 CAC

Price Range: $1,500 – $1,800

Famously weakly struck; true MS63s with eye appeal are rare birds. O‑mint devotees continue to bid aggressively for well‑struck examples. - 1948 Franklin Half Dollar – MS65 FBL CAC

Price Range: $500 – $700

First‑year Franklin with Full Bell Lines. FBL premiums, once niche, are now mainstream, and CAC FBL coins remain underpriced relative to rarity. - 1901‑P Morgan Dollar – MS63 CAC

Price Range: $1,200 – $1,500

The Philadelphia key date. Poor striking standards mean every solid MS63 is automatically a condition rarity—yet still trades below historical highs.

Building a Medium‑Term Portfolio

Acquisition Principles

- Fundamental Rarity First – favor genuine scarcity over population‑spike fads.

- Certification Quality – target CAC where available; insist on original, problem‑free surfaces.

- Phased Buying – dollar‑cost average over 12‑24 months, leaning in during market softness.

- Strategic Diversification – spread capital across at least five of the ten categories, with both silver and gold exposure.

Example Allocations (≈ $5 k Each)

| Strategy | Coin Mix | Cost | 5‑Yr Return Target* |

|---|---|---|---|

| Aggressive | 1881‑CC MS64 CAC, 1890‑CC MS63 CAC, 1886‑O MS63 CAC | $4,800 | 80‑100 % |

| Balanced | 1881‑CC MS63 CAC, 1890‑CC MS63 CAC, 1892 Columbian MS65 CAC, 1948 Franklin MS65 FBL CAC, 1908‑D Indian MS62 CAC | $4,925 | 70‑90 % |

| Conservative | 1881‑CC MS63 CAC, 1892 Columbian MS65 CAC, 1948 Franklin MS65 FBL CAC, 1908‑D Indian MS62 (non‑CAC), 1886‑O MS62 CAC, 1901‑P MS62 CAC | $4,975 | 60‑80 % |

*Return targets are directional estimates based on prior cycle behavior; they are not guarantees.

Monitoring & Exit Discipline

| Task | Frequency | Actionable Trigger |

|---|---|---|

| Compare auction comps | Semi‑annually | ≥ 25 % move vs. cost prompts partial sale review |

| Review grading‑service populations | Annually | Population spikes > 10 % may cap further upside |

| Track series‑wide sentiment | Ongoing | Shifts in collector focus can accelerate or delay exits |

Pre‑‑set price objectives using long‑term premium ranges and stage exits across multiple venues (major auctions, boutique dealers, or peer‑to‑peer platforms) to avoid flooding the market.

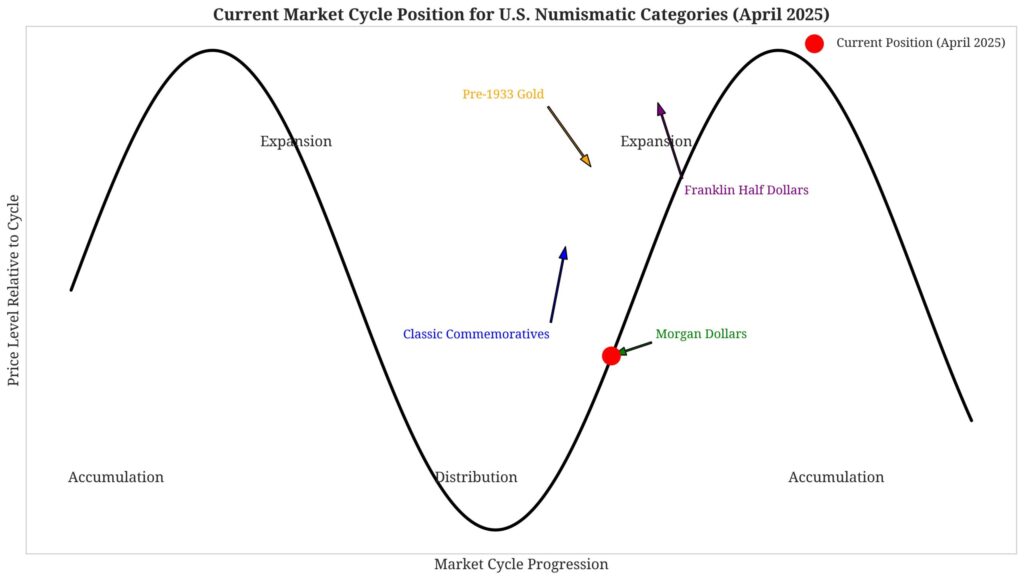

Market‑Cycle Context (2025 Outlook)

We are late in the current rare‑coin expansion but not yet at euphoric peak conditions. Over the next three to five years:

- Selective Appreciation – only true rarities outperform; generic material may stagnate.

- Quality Spread – CAC, FB/FBL/PL, and high‑grade premiums likely keep widening.

- Historical Narrative – coins with a story (first year, branch mint, expositions) continue to outstrip commodity‑driven issues.

- Metal Underpinning – elevated gold and silver prices should reinforce value floors.

Final Thoughts

The ten coins above marry fundamental scarcity with near‑term demand catalysts, giving medium‑term investors an attractive convexity profile: limited downside, outsized upside. Success hinges on disciplined acquisition, active monitoring, and a well‑planned exit strategy. Execute those elements, and a three‑ to five‑year holding period should prove rewarding—whether the next market cycle booms, stagnates, or merely grinds higher.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Consult a qualified professional before making any investment decisions.

Leave a Reply